dariopierro.online

Categories

Adp Payroll Monthly Cost

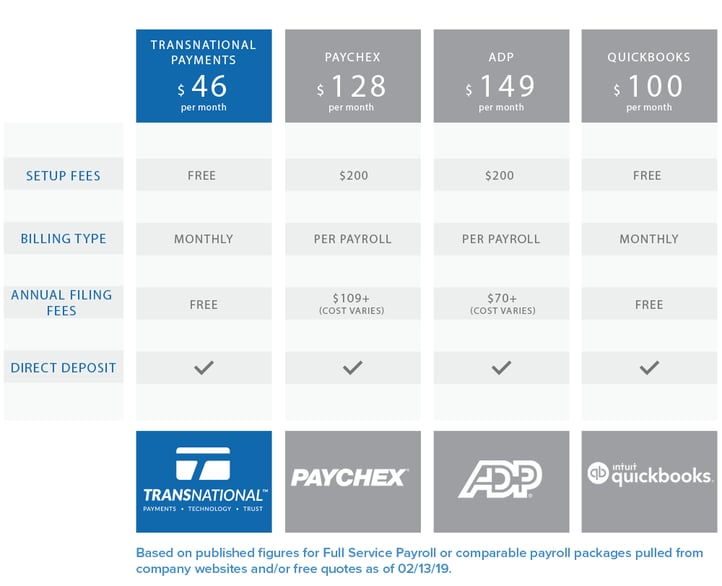

charge a base amount and a monthly fee per employee for unlimited payroll runs. However, ADP's payroll costs vary based on several factors, including payroll. ADP Payroll Services Plans & Pricing ; Roll. $29 ; Essentials. $59 ; Enhanced. Custom ; Complete. Custom. Get details and pricing for RUN Powered by ADP®, the industry-leading small business payroll solution. cost of payroll and making it more cost-efficient. XX Month 0 Comments To dive further into the topic of payroll cost efficiencies, download ADP's. How much do payroll services cost? Different payroll providers offer different pricing structures, but most have per-payroll processing or per-employee fees. Roll by ADP mobile payroll app · Businesses that want a low-cost solution: $17 per month plus $5 per employee. · Businesses that have simple payroll needs. ADP. Pricing Model: Charged per payroll run. Cost: Approx. $ – $ per employee per payroll run. ADP charges per. ADP payroll prices and options review – UK costs guide. ✓ Last updated on 30 May Are you looking for ADP payroll costs? As businesses grow and. Basic · $ / month · $ / report / month. For 1 Report And Above · Setup fee: $ charge a base amount and a monthly fee per employee for unlimited payroll runs. However, ADP's payroll costs vary based on several factors, including payroll. ADP Payroll Services Plans & Pricing ; Roll. $29 ; Essentials. $59 ; Enhanced. Custom ; Complete. Custom. Get details and pricing for RUN Powered by ADP®, the industry-leading small business payroll solution. cost of payroll and making it more cost-efficient. XX Month 0 Comments To dive further into the topic of payroll cost efficiencies, download ADP's. How much do payroll services cost? Different payroll providers offer different pricing structures, but most have per-payroll processing or per-employee fees. Roll by ADP mobile payroll app · Businesses that want a low-cost solution: $17 per month plus $5 per employee. · Businesses that have simple payroll needs. ADP. Pricing Model: Charged per payroll run. Cost: Approx. $ – $ per employee per payroll run. ADP charges per. ADP payroll prices and options review – UK costs guide. ✓ Last updated on 30 May Are you looking for ADP payroll costs? As businesses grow and. Basic · $ / month · $ / report / month. For 1 Report And Above · Setup fee: $

$39/mo. + $5 per employee. Unlimited payroll; Three months free*; No long-term contracts.

Automated online payroll that helps avoid costly errors · Payroll taxes calculated and paid on your behalf · Federal, state, and local compliance support · Simple. The Average Cost of a basic Payroll Software plan is $19 per month. 37% of Does ADP Payroll Services offer a free plan? No, ADP Payroll Services. Weekly Payroll. Biweekly Payroll. Semi Monthly Payroll. Monthly Payroll. Monthly Maintenance Fees. Seasonal Hold Monthly Maintenance Fees. Additional. When we requested a quote for the Enhanced plan for a business with 25 employees paid biweekly, ADP gave us a price estimate of $ per payroll, plus $ per. U got in with ADP payroll at only $25 per month total? Im currently contracting them and they quoted me for 2 employees at $ per month. $39/mo. + $5 per employee. Unlimited payroll; Three months free*; No long-term contracts. Compare pricing and features: Gusto vs ADP ; Monthly fee, Starting at $40/mo + $6/mo per person. No upfront pricing ; Setup fee, Free. Extra fees ; Payroll. ADP - ADP's pricing varies depending on the specific services and features you need. Their basic payroll service starts at $59 p. Continue. Although ADP runs on a custom quote basis on their website, research says that you can expect to pay at least $+ for employees. The cost will depend on. ADP Payroll Solutions. ADP Preferred Rewards for Business members may be eligible to receive a $$20 credit towards your monthly payroll service fees. After you request this offer through TechSoup and pay the admin fee, you'll pay a $25 setup fee plus the discounted rate for any payroll services to ADP. To. You're done with payroll in under a minute! Start 4 Month Free Trial How much does payroll for one employee typically cost? The price will hinge. Small business payroll that's fast, smart and easy · Payroll done faster, tax filing done for you · Help avoid costly mistakes before they happen. Does the ADP National Employment Report forecast the Bureau of Labor Statistics monthly non-farm payroll report? No. The ADP National Employment Report is an. Explore small business software packages + pricing from ADP. Compare payroll & HR bundle plan details and learn why small business in Canada choose ADP. ADP charges companies on a per employee per month basis. A typical ADP Workforce Now subscription can cost anywhere from $ PEPM, depending on the size. ADP payroll clients have reported paying up to $ per year plus an initial setup fee of up to $ for ADP Section POP administration. Price Plans · ADP has multiple plans that fit into two categories, depending on the number of employees. · Although the company's not too upfront about its. ADP Workforce Now starts at $62 per month plus a per-employee fee for the most basic program. ADP TotalSource prices are not listed online, but similar services. ADP Run vs Gusto: Compare features and pricing ; Per worker cost, No published price. Negotiate with sales. Price is per pay run, not monthly. Starting at $6 per.

What Is A Good Interest Rate For A Car Lease

, the interest rate is approximately 7%. According to dariopierro.online, a lease deal with a money factor of less than is a good deal — this equals %. Lower interest rates available with multiple security deposits: Toyota Financial offers a way for the lease client to lower their interest rate by up to %. A decent money factor for a lessee with great credit, a credit score of or above, is typically around or 6%. credit score – You'll get a good rate, usually around %. credit score – Your rate will be decent in the Examine & compare whether you should purchase or lease your next Ford vehicle Your monthly payment covers the cost of the entire vehicle over the life. What is the car lease money factor? This is the "interest rate" you'll pay during your lease. It's sometimes called a "lease factor" or even a "lease fee. If you got financing offers before going to the dealer, you'd know that you qualify for an interest rate of around 4 percent, and you can show the dealer the. day rate lock guarantee Your rate is good for 30 days, so you'll have plenty of time to shop for that perfect vehicle. Interest rate discount. Bank of. The rate we get is based on our credit score. Different lenders will offer different interest rates. The rate should be between 2% and 5%. , the interest rate is approximately 7%. According to dariopierro.online, a lease deal with a money factor of less than is a good deal — this equals %. Lower interest rates available with multiple security deposits: Toyota Financial offers a way for the lease client to lower their interest rate by up to %. A decent money factor for a lessee with great credit, a credit score of or above, is typically around or 6%. credit score – You'll get a good rate, usually around %. credit score – Your rate will be decent in the Examine & compare whether you should purchase or lease your next Ford vehicle Your monthly payment covers the cost of the entire vehicle over the life. What is the car lease money factor? This is the "interest rate" you'll pay during your lease. It's sometimes called a "lease factor" or even a "lease fee. If you got financing offers before going to the dealer, you'd know that you qualify for an interest rate of around 4 percent, and you can show the dealer the. day rate lock guarantee Your rate is good for 30 days, so you'll have plenty of time to shop for that perfect vehicle. Interest rate discount. Bank of. The rate we get is based on our credit score. Different lenders will offer different interest rates. The rate should be between 2% and 5%.

day rate lock guarantee Your rate is good for 30 days, so you'll have plenty of time to shop for that perfect vehicle. Interest rate discount. Bank of. The average interest rate on a three-year car loan is around 3% to %. Naturally, the offer that a Bremerton driver can expect depends upon their credit store. Toyota vehicles are world renowned for their longevity. Financing a new Toyota can be a cost effective option for anyone looking to drive their vehicle for a. Lease buyout loan rates ; Auto Approve logo, %, $10,$, ; MyAutoLoan logo, %, $8,+ ; DCU logo, %, Up to % of the car's value ; PNC logo. Having a good to excellent credit score ( using Experian's credit margins, or using Equifax) will help you qualify for the lowest interest rates. better from their point-of-view. Interest Rates. In terms of a loan, interest rates have a major effect on the cost of lease financing. Since the outstanding. better from their point-of-view. Interest Rates. In terms of a loan, interest rates have a major effect on the cost of lease financing. Since the outstanding. Any late payments could result in hefty fees and increased interest rates, and any missed payments could result in repossession of the vehicle and serious. If the monthly payment is known, use the "Fixed Pay" tab to calculate the effective interest rate. Or use the Auto Lease Calculator regarding auto lease for. It also allows co-borrowers and co-signers, which can help you get a better interest rate. car, a car lease is a good alternative. You don't want to. Generally, car lease interest rates range from 3% to 15%. Example of how car loans for a leased vehicle work. Suppose you want to lease a car for $30, over. Term in months for your auto lease. Lease interest rate. Annual interest rate for your lease. Other fees. Any fee, other than a capital reduction. What is a good interest rate for a month car loan? better interest rates. Those with low credit scores may be able to use a cosigner to secure a loan or a lower rate as well. Individuals with questions about. The interest rates for car leasing vary from provider to provider. They are usually between % and 7% (as of July ) — some lessors even offer 0%. Note. Find the Best Lease Deals on Canada's #1 Automotive Lease Marketplace. Browse all Lease Offers and Specials available throughout Canada. You may lease or finance another Toyota vehicle; Toyota Financial Services offers convenient financing and great rates should you choose to purchase the vehicle. The average interest rate on a three-year car loan is around 3% to %. Naturally, the offer that a Bremerton driver can expect depends upon their credit store. With captive leasing banks, the interest rates usually depend on the vehicle effective interest rate is now hidden behind promotions and additional services.

Best Tax Relief Companies

I have a good friend who has about 25K in tax debt and penalties. Maybe not all tax relief companies are the same, despite promising the same. Unlike other IRS tax resolution and tax debt relief companies in Denver We want the tax debt relief services we provide to be such a great. Best tax relief companies · Best for affordability: Community Tax · Best for customer service: Precision Tax Relief · Best for in-person assistance: Tax Defense. When choosing the best tax debt relief companies, you need a company licensed, bonded, 20+ years experience, A+ rated, and top rated by independent review. A tax relief company worth contacting will have qualities that allow you to feel safe and secure in seeking a resolution for your tax issues with them. Here are. The term “Tax Relief Company” is synonymous with large firms that are just sales and marketing companies. However, the services they provide are a necessary. Review of the 4 best tax relief companies · Anthem Tax Services · Larson Tax Relief · Community Tax · Precision Tax Relief. Precision Tax Relief. Choose the Most Trusted Tax Relief Company Precision Tax Relief has a 98% satisfaction rating in over reviews—more than any other tax relief agency. We. Discover top-rated tax relief companies, learn how to resolve back taxes and unravel effective tax relief strategies for a financially sound future. I have a good friend who has about 25K in tax debt and penalties. Maybe not all tax relief companies are the same, despite promising the same. Unlike other IRS tax resolution and tax debt relief companies in Denver We want the tax debt relief services we provide to be such a great. Best tax relief companies · Best for affordability: Community Tax · Best for customer service: Precision Tax Relief · Best for in-person assistance: Tax Defense. When choosing the best tax debt relief companies, you need a company licensed, bonded, 20+ years experience, A+ rated, and top rated by independent review. A tax relief company worth contacting will have qualities that allow you to feel safe and secure in seeking a resolution for your tax issues with them. Here are. The term “Tax Relief Company” is synonymous with large firms that are just sales and marketing companies. However, the services they provide are a necessary. Review of the 4 best tax relief companies · Anthem Tax Services · Larson Tax Relief · Community Tax · Precision Tax Relief. Precision Tax Relief. Choose the Most Trusted Tax Relief Company Precision Tax Relief has a 98% satisfaction rating in over reviews—more than any other tax relief agency. We. Discover top-rated tax relief companies, learn how to resolve back taxes and unravel effective tax relief strategies for a financially sound future.

Clean Slate Tax offers expert tax relief solutions to help individuals and businesses resolve IRS debt issues. Get a free consultation and explore services. Top Tax Defenders, located in Houston, Texas, is dedicated to helping people with their back tax and IRS audit problems. So the best way to avoid a scam is to avoid these companies all together. Find a local tax professional to help you. We prefer tax attorneys for selfish. Contact our tax relief specialists to solve your tax problems. We can help with liens, wage garnishment, bank levy, or plans by the IRS to seize your. Optima's tax attorneys and licensed tax professionals specialize in tax relief assistance programs designed to help resolve IRS and state tax liabilities. 1. Tax Hardship Center: Best for Back Taxes Relief 2. Community Tax: Best for Ongoing Tax Monitoring 3. Larson Tax Relief: Best for Large Tax Debts and. Below is SuperMoney's list of the best tax resolution companies based on our algorithms and community feedback. Do Tax Relief Companies Really Work? That depends. Unfortunately, the industry is rife with scams and poor business practices. Disreputable companies lure. The Top 5 Ways to Pay IRS Tax Debt in Full Tax Defense Network is a well-established tax resolution company that specializes in finding affordable solutions. Alleviate Tax provides tax relief services that can substantially reduce your tax liability, possibly saving you tens of thousands in penalties, interest, and. Victory Tax Lawyers · Free Attorney Consultation · Best Rated by Multiple Review Sites and Organizations · Accredited with an A+ Rating from the Better Business. Anthem Tax Services · $10, Minimum Tax Debt Requirement · Money-Back Guarantee · Fees Start at $ View Profile Visit Site. tax relief firms that heavily advertises, and they essentially confirmed what many thought. Best Tax Debt Relief Companies. Tax Defense Network is highly rated & has high customer satisfaction. Their prices are at the higher end but they have resolved over $ million in client. Tax relief services help you deal with IRS and state tax problems. A tax relief specialist helps you find the best options for your situation. Sound too good to be true? Some tax relief companies may guarantee to lower your tax obligations. Others might tell you that they have “insider tips” or. Contact our tax relief specialists to solve your tax problems. We can help with liens, wage garnishment, bank levy, or plans by the IRS to seize your. Do you need help with Tax Resolution? Do you owe back taxes? Do you need help with dealing with the IRS? Do you have unfiled returns? With so many different tax relief companies out there, which is going to give you the best solution as well as the greatest peace of mind the fastest? In this article, we'll walk you through everything you need to know to choose the right tax relief company.

Earned Income Ira

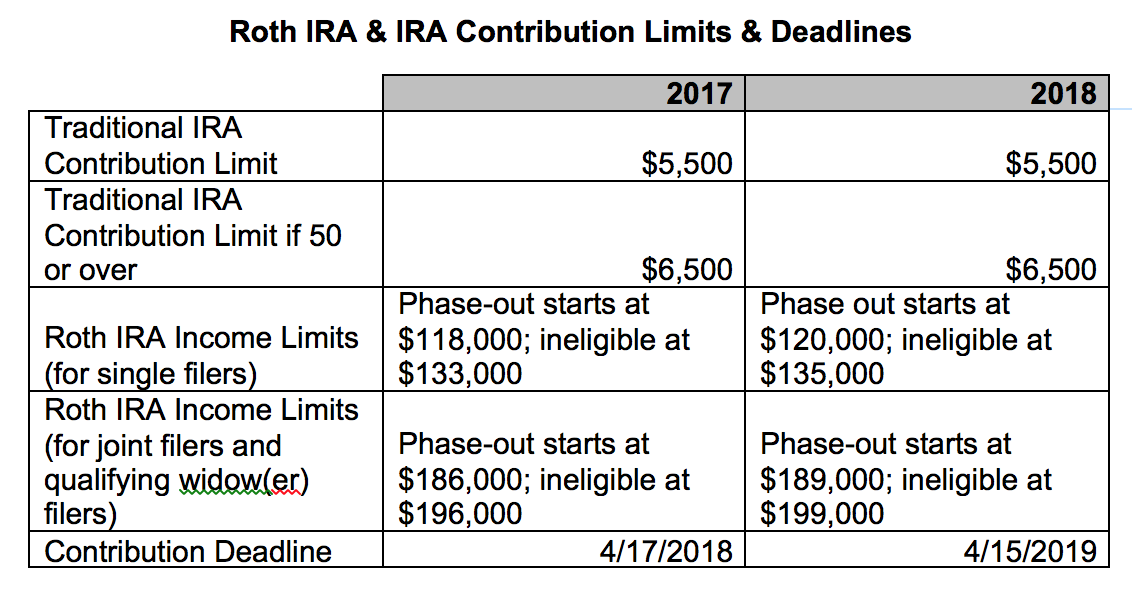

Earned income includes commissions, wages, alimony, and other payments that meet IRS criteria. But you can't use interest and dividend income (among other. A Spousal IRA creates an exception to the provision that an individual must have earned income to contribute to an IRA. Spouses with no income or very little. The limit for contributions to traditional and Roth IRAs for is $, plus an additional $ if the taxpayer is age 50 or older. Yet, even as the Secure Act lifts the age limit on traditional IRA contributions, IRA contributions still carry strictures. Having earned income is the first. American citizens not resident in the U.S. may contribute to an IRA. However, they must have earned income that is not excluded by the foreign earned income. IRA Income and Contribution Limits · $7, if you're under 50 years old · $8, if you're 50 or older. If you are age 50 or older, you may contribute $8, a year. Income requirements. You or your spouse must have earned income to contribute. However you cannot. Generally, if you're not earning any income, you can't contribute to either a traditional or a Roth IRA. However, in some cases, married couples filing jointly. You can keep contributing as long as you or your spouse is earning income. If I participate in a workplace retirement plan, does it make sense to contribute to. Earned income includes commissions, wages, alimony, and other payments that meet IRS criteria. But you can't use interest and dividend income (among other. A Spousal IRA creates an exception to the provision that an individual must have earned income to contribute to an IRA. Spouses with no income or very little. The limit for contributions to traditional and Roth IRAs for is $, plus an additional $ if the taxpayer is age 50 or older. Yet, even as the Secure Act lifts the age limit on traditional IRA contributions, IRA contributions still carry strictures. Having earned income is the first. American citizens not resident in the U.S. may contribute to an IRA. However, they must have earned income that is not excluded by the foreign earned income. IRA Income and Contribution Limits · $7, if you're under 50 years old · $8, if you're 50 or older. If you are age 50 or older, you may contribute $8, a year. Income requirements. You or your spouse must have earned income to contribute. However you cannot. Generally, if you're not earning any income, you can't contribute to either a traditional or a Roth IRA. However, in some cases, married couples filing jointly. You can keep contributing as long as you or your spouse is earning income. If I participate in a workplace retirement plan, does it make sense to contribute to.

Amount of relief. The amount of Earned Income Relief is based on your age and taxable earned income (less any allowable expenses) in the previous year. * If. A spousal IRA is a regular IRA, either Traditional or Roth, that allows a non-wage earning spouse to contribute to their own IRA to help save. It is a trust that holds investment assets purchased with a taxpayer's earned income for the taxpayer's eventual benefit in old age. You can contribute to an IRA if you (or your spouse, if filing jointly) have “taxable compensation,” also known as “earned income.” The following table shows. To contribute to an IRA, you must have an earned income. Earned income is simply any type of taxable income, such as wages, salaries, and tips. Additionally, contribution rules for IRAs state that an individual must have earned income to contribute to an IRA in a given year. The IRS provides a unique. Many factors can affect your eligibility and contribution limits to either the traditional IRA or Roth IRA: tax filing status, your current earned income level. When figuring how much qualifying income you have to support your IRA contribution, it's your net earnings from self-employment that count. Subtract your. A Spousal IRA creates an exception to the provision that an individual must have earned income to contribute to an IRA. Spouses with no income or very little. Under the current Nebraska tax code, earned income and distributions from a Premiums are based on income, and a large distribution from a Traditional IRA can. Tax Breaks for Roth IRA Contributions · Taxpayers who are married and filing jointly must have incomes of $73, or less. ($76, or less in ) · All head of. There are no income limits for a traditional IRA, but how much you earn has a direct bearing on how much you can contribute to a Roth IRA. Generally, if you're not earning any income, you can't contribute to either a traditional or a Roth IRA. However, in some cases, married couples filing jointly. It is a common mis-held belief that retirement plan contributions can be based on total income (that is, earned income plus passive income), but this is not. Spousal IRAs. If you're married and your spouse doesn't have earned income or makes less compensation than you, you can open an IRA account for them. You can. 6. You can open a Roth IRA for a child who has taxable earned income Helping a young person fund an IRA—especially a Roth IRA—can be a great way to give them. IRA distributions are generally included in the recipient's gross income and taxed as ordinary income, other than qualified distributions from a Roth IRA. American citizens not resident in the U.S. may contribute to an IRA. However, they must have earned income that is not excluded by the foreign earned income. If you're in a single-income marriage, saving for retirement can be tough. How can a non-working spouse with no earned income still achieve their financial. However, some incomes that don't meet the earned income include rental income, capital gains, IRA distributions, social security, interest income, and dividend.

Mutual Funds Versus Stocks

Both ETFs and Mutual Funds offer a way for investors to pool money into a fund that make investments in a collection of stocks, bonds, or other assets. ETFs trade like stocks and are listed on stock exchanges and sold by broker-dealers. Mutual funds, on the other hand, are not listed on stock exchanges and can. Learn how to decide between mutual funds, ETFs, and individual securities, and see how to narrow your options down. As you can see, each type of investment has its own potential rewards and risks. Stocks offer an opportunity for higher long-term returns compared with bonds. Mutual funds, on the other hand, are not traded on an exchange. Instead, they are bought and sold directly through the mutual fund company or through a broker. For instance, mutual funds are perfect if you want to hold onto the investment for 5 years. Further, stocks are less liquid than mutual funds since they cannot. Differences between ETFs & mutual funds An ETF could be more suitable for you. You can buy an ETF for the price of 1 share—commonly referred to as the ETF's. Both shares and mutual funds represent investment opportunities, they require a different approach for the same. Beside the steps of investing in them. Mutual funds provide diversification, professional management, and tax benefits, making them a better choice for many investors. Both ETFs and Mutual Funds offer a way for investors to pool money into a fund that make investments in a collection of stocks, bonds, or other assets. ETFs trade like stocks and are listed on stock exchanges and sold by broker-dealers. Mutual funds, on the other hand, are not listed on stock exchanges and can. Learn how to decide between mutual funds, ETFs, and individual securities, and see how to narrow your options down. As you can see, each type of investment has its own potential rewards and risks. Stocks offer an opportunity for higher long-term returns compared with bonds. Mutual funds, on the other hand, are not traded on an exchange. Instead, they are bought and sold directly through the mutual fund company or through a broker. For instance, mutual funds are perfect if you want to hold onto the investment for 5 years. Further, stocks are less liquid than mutual funds since they cannot. Differences between ETFs & mutual funds An ETF could be more suitable for you. You can buy an ETF for the price of 1 share—commonly referred to as the ETF's. Both shares and mutual funds represent investment opportunities, they require a different approach for the same. Beside the steps of investing in them. Mutual funds provide diversification, professional management, and tax benefits, making them a better choice for many investors.

The decision between investing in mutual funds versus stocks depends on several factors, including an individual's investment goals, risk tolerance and. Mutual funds and stocks both have their pros and cons, and the best investment option for you will depend on your personal financial goals, risk tolerance, and. The decision between investing in mutual funds versus stocks depends on several factors, including an individual's investment goals, risk tolerance and. Mutual funds and stocks both have their pros and cons, and the best investment option for you will depend on your personal financial goals, risk tolerance, and. ETFs vs. Mutual Funds vs. Stocks ; ETFs diversify risk by creating a portfolio that can span multiple asset classes, sectors, industries, and security. Single Stocks vs Mutual Funds · The opposite of the diversification issue: If you own just one stock and it doubles, you are up %. · If you hold your stocks. ETFs often generate fewer capital gains for investors than mutual funds. This is partly because so many of them are passively managed and don't change their. Mutual funds are groups of stocks. When you buy a share in a mutual fund you get a tiny fraction of each stock in the fund giving you better diversification. Average net expense ratio for ETFs vs. active mutual funds* · Lower cost: ETFs, many of which are passively managed, offer lower fees than active mutual funds. To answer about fees, stocks have no fees anymore to purchase nor are there expense ratios. Mutual funds (or ETFs) will mostly have underlying. Differences · 1. ETFs are traded on stock exchanges, while mutual funds are not. · 2. ETFs typically have lower fees than mutual funds. · 3. ETFs can be bought and. When you buy shares of a fund, you become a part owner of the fund, and you share in its profits. For example, when the fund's underlying stocks or bonds pay. Mutual funds usually offer better diversification compared to equity investments. Mutual fund companies pool money from multiple investors to invest in a. When you buy a share in a fund, you're really buying a piece of a large, diverse portfolio. Conversely, stocks are shares of a single company. Stocks vs. Funds. The difference of course is that ETFs are "exchange traded." That means you can buy and sell them intraday, like any other stock. By contrast, you can only buy. ETFs trade like stocks and are listed on stock exchanges and sold by broker-dealers. Mutual funds, on the other hand, are not listed on stock exchanges and can. Index funds and mutual funds both pool investors' money to buy many different securities, but index funds use a passive investment strategy. The key difference between individual stocks and a mutual fund is investing in a single company versus investing in a collection. With stocks, you are putting. When an investor buys a stock, part ownership in the form of a share is bought. · Bonds are a type of investment designed to aid governments and corporations to.

Amazon Delivery Driver Complaint Number

The best phone number to call Amazon Logistics is 91% of consumers used this number to address their issues and concerns. It is also considered the. delivery driver. She was asked by the driver on the 20th Nov to provide the last 2 digits of my mobile number, which of course she knew and. Visit the Amazon Customer Service site to find answers to common problems, use online chat, or call customer service phone number at for. Based on Amazon's representations, drivers expect that they will earn the hourly rate. Amazon promised plus % of customer tips. Amazon's Specific Delivery. Visit the Amazon Customer Service site to find answers to common problems, use online chat, or call customer service phone number at for. Delivery driver must have excellent customer service and driving skills. A Route times up to 8 hours depending on number of assigned delivery stops and your. Call this number it's to Amazon customer service 1 () I had a package that was a problem occurred I never received it because it was damaged in. Contact Amazon Customer Service: You can reach out to Amazon's customer service—— department through their website or app. They. How to contact Amazon Customer Service: Scroll to the bottom of the page. Select Customer Service. Select the option that addresses your question. The best phone number to call Amazon Logistics is 91% of consumers used this number to address their issues and concerns. It is also considered the. delivery driver. She was asked by the driver on the 20th Nov to provide the last 2 digits of my mobile number, which of course she knew and. Visit the Amazon Customer Service site to find answers to common problems, use online chat, or call customer service phone number at for. Based on Amazon's representations, drivers expect that they will earn the hourly rate. Amazon promised plus % of customer tips. Amazon's Specific Delivery. Visit the Amazon Customer Service site to find answers to common problems, use online chat, or call customer service phone number at for. Delivery driver must have excellent customer service and driving skills. A Route times up to 8 hours depending on number of assigned delivery stops and your. Call this number it's to Amazon customer service 1 () I had a package that was a problem occurred I never received it because it was damaged in. Contact Amazon Customer Service: You can reach out to Amazon's customer service—— department through their website or app. They. How to contact Amazon Customer Service: Scroll to the bottom of the page. Select Customer Service. Select the option that addresses your question.

Being a delivery driver is easy with the Amazon Flex app. We'll guide you Valid ID: Ensure you have a valid driver's license and a Social Security Number. Amazon executive customer service contacts · How can I contact Amazon by email? · Is () Amazon's phone number? · Does Amazon offer 24/7 customer. Contact us to report the incident to Amazon. Follow the prompts until you have the option to speak with an agent and report your issue over the phone. We work with the following carriers to deliver items. If you have an issue with your delivery, you can contact the carriers directly. Report the incident to Amazon by calling to receive 24/7 immediate assistance. Report the incident to Amazon by calling to receive 24/7 immediate assistance. I've used the Amazon Lockers in the past and would love to see them expand those. There are a good number of Locker locations here in San Diego, but they're. delivered the next day. Same day at pm I received a text from that odd number saying I have a message from Amazon delivery driver. I took the risk and. Examples of approved third party providers include package, restaurant and grocery delivery companies. * Available for eligible properties only. 8. How can I. I've used the Amazon Lockers in the past and would love to see them expand those. There are a good number of Locker locations here in San Diego, but they're. Amazon Logistics - Track here · Contact Us ; Ninja Van - Track here. Monday - Friday: AM to PM. Local: +65 Contact Us ; SF Express - Track. Amazon box truck drove closely by us at an excessive speed considering the circumstances. He was driving registration number *Removed Personal Info*. We. Want to deliver for Amazon Flex? Get all your questions answered from how to start earning with Flex, how to earn more through our rewards program and more. Contacting Customer Service via the Amazon website is the ideal option but you can send Feedback via any Amazon app. Join us as our teams work to add value to every step of the customer experience—from shipping, to delivery, post-purchase, and returns. Building customer trust. Jessica Huseman shared a viral TikTok showing her amazon delivery driver setting down packages and explaining how her house is unsafe as there are no. Get quick answers, ask UPS Virtual Assistant, FAQ, where's my package?, my shipment says “Out for Delivery.” What time will it be delivered? Get quick answers, ask UPS Virtual Assistant, FAQ, where's my package?, my shipment says “Out for Delivery.” What time will it be delivered? delivery is scheduled or requires a signature. For those deliveries, drivers may call or text the phone number you provided for your order. The call or text. number, which route number, which staging area at the warehouse. Experienced drivers are familiar with dozens of routes, can drive any of.

Best Healthcare In Washington State

The UW Medicine healthcare system includes UW Medical Center, rated the #1 hospital in Washington by the U.S. News & World Report. The University of Washington Medical Center is the No. 1 hospital in Washington state and in the Seattle metropolitan area, according to US News & World Report. University of Washington Medical Center, part of the UW Medicine health system, today earned US News & World Report's No. 1 hospital ranking in Washington. Healthcare Companies in Washington State · CVS Health · Kaiser Permanente · DaVita · UnitedHealth Group · Labcorp · Elevance Health · HCA Healthcare · Optum. University of Washington Medical Center, part of the UW Medicine health system, today earned US News & World Report's No. 1 hospital ranking in Washington. Jefferson Healthcare, Jefferson. Kadlec Regional Medical Center, Benton. Kaiser Permanente Washington, King. Kindred Hospital Seattle – First Hill, King. America's Best-In-State Hospitals ; 1, University of Washington Medical Center, % ; 2, Virginia Mason Medical Center, % ; 3, EvergreenHealth Medical. Best Practices Medical Clinic, Bogachiel Clinic - Forks, Capitol Family See how people's health and care compare across Washington State. Better or. Regence Blue Cross Blue shield is great where I am. I'm in SW Washington and don't have to go into Portland, Or for anything. The UW Medicine healthcare system includes UW Medical Center, rated the #1 hospital in Washington by the U.S. News & World Report. The University of Washington Medical Center is the No. 1 hospital in Washington state and in the Seattle metropolitan area, according to US News & World Report. University of Washington Medical Center, part of the UW Medicine health system, today earned US News & World Report's No. 1 hospital ranking in Washington. Healthcare Companies in Washington State · CVS Health · Kaiser Permanente · DaVita · UnitedHealth Group · Labcorp · Elevance Health · HCA Healthcare · Optum. University of Washington Medical Center, part of the UW Medicine health system, today earned US News & World Report's No. 1 hospital ranking in Washington. Jefferson Healthcare, Jefferson. Kadlec Regional Medical Center, Benton. Kaiser Permanente Washington, King. Kindred Hospital Seattle – First Hill, King. America's Best-In-State Hospitals ; 1, University of Washington Medical Center, % ; 2, Virginia Mason Medical Center, % ; 3, EvergreenHealth Medical. Best Practices Medical Clinic, Bogachiel Clinic - Forks, Capitol Family See how people's health and care compare across Washington State. Better or. Regence Blue Cross Blue shield is great where I am. I'm in SW Washington and don't have to go into Portland, Or for anything.

1. Kadlec Regional Medical Center. Zippia Score #1 Best health care company to work. Community Health Plan of Washington offers affordable high quality health care that gives you extended coverage and added value. UW Medical Center, part of the UW Medicine health system, has earned US News & World Report's No. 1 ranking for care in Washington state and in the Seattle. America's Best-In-State Hospitals ; 1, University of Washington Medical Center, % ; 2, Virginia Mason Medical Center, % ; 3, EvergreenHealth Medical. UW Medical Center, part of the UW Medicine health system, has earned US News & World Report's No. 1 ranking for care in Washington state and in the Seattle. Healthcare Safety Network (NHSN), and the Washington State Hospital Association. best practices to improve patient safety and reduce medical errors. About Us. Washington Accepted Health Insurance Plans · Aetna – Commercial · Blue Shield of WA and Asuris – Commercial · CHPW – Washington Medicaid (PENDING) · CIGNA –. Jefferson Healthcare is an award winning healthcare system providing care to all patients across Jefferson County. Washington runs a state-based marketplace called Washington Healthplanfinder, which is managed by Washington state Health Care Authority in collaboration with. Worst: Washington, D.C.. Average Monthly Insurance Premium Best: Minnesota Worst: Wyoming. QUALITY. Average Life. Top Healthcare Companies in Washington State · Filter Companies · Providence · Kaiser Permanente · Labcorp · Optum · Seattle Children's · UnitedHealth Group · MultiCare. The best health care companies to work for in Washington are Kadlec Regional Medical Center, Olympic Medical Center, MultiCare Rockwood Clinic and more. MultiCare provides hospital, clinic, primary care, specialty, emergency and urgent care health care services across Washington state. Oxfam America study ranks Washington best state — based on worker protections, healthcare and unemployment during COVID pandemic Washington. Opened in , Washington Hospital Healthcare System has grown to include a bed, acute-care hospital, ready to serve our community's health needs. Applying for coverage through Washington Healthplanfinder is the best way to learn if you qualify for a free or reduced-cost plan. When you apply through. Ranked Among the Best for More Than 30 Years We're honored to share that U.S. News & World Report has named Seattle Children's among the best children's. The number 1 hospital in Washington is UW Medicine-University of Washington Medical Center. See also Best Children's Hospitals in Washington. If you live in the state of Washington, you can buy health insurance through Washington Healthplanfinder, even if you are an immigrant who is undocumented. The Affordable Care Act also offered funding to states to expand Medicaid eligibility. To date, 39 states and Washington, D.C. have done so. Given how important.

How Much Should Be In My Savings Account

Saving Should Be Your Biggest Expense · Needs (like mortgage or rent, utilities, healthcare, food, and childcare expenses) should be paid with 50% of your budget. Many experts recommend 20% of your paycheck toward your total savings, which includes retirement, short-term savings, and any other savings goals. But exactly. Savings account: 2 to 4 months of expenses. After allocating one to two months of your expenses into a checking account, Anderson says that the two to four. Your checking account should equal two months of your average living expenses. That's what the balance should be because sometimes those amounts. National Average is based on the APY average for savings accounts with a minimum balance of at least $2, as reflected in the FDIC's published National Rates. The 50/30/20 budget, for instance, is a strategy that suggests allocating 50% of your income to necessities, 30% to personal spending, and 20% to savings. Ways. However, a good rule of thumb for a year-old is to have $6, in a savings account for emergencies and long-term financial goals. And that requires you to. For example, try out a few different scenarios where you save in accounts that have different interest rates. Then see how the size of your initial deposit. How much money should I have in savings? Experts agree that having at least 3 months' worth of expenses in your savings account is a good strategy. This will. Saving Should Be Your Biggest Expense · Needs (like mortgage or rent, utilities, healthcare, food, and childcare expenses) should be paid with 50% of your budget. Many experts recommend 20% of your paycheck toward your total savings, which includes retirement, short-term savings, and any other savings goals. But exactly. Savings account: 2 to 4 months of expenses. After allocating one to two months of your expenses into a checking account, Anderson says that the two to four. Your checking account should equal two months of your average living expenses. That's what the balance should be because sometimes those amounts. National Average is based on the APY average for savings accounts with a minimum balance of at least $2, as reflected in the FDIC's published National Rates. The 50/30/20 budget, for instance, is a strategy that suggests allocating 50% of your income to necessities, 30% to personal spending, and 20% to savings. Ways. However, a good rule of thumb for a year-old is to have $6, in a savings account for emergencies and long-term financial goals. And that requires you to. For example, try out a few different scenarios where you save in accounts that have different interest rates. Then see how the size of your initial deposit. How much money should I have in savings? Experts agree that having at least 3 months' worth of expenses in your savings account is a good strategy. This will.

It's our simple guideline for saving and spending: Aim to allocate no more than 50% of take-home pay to essential expenses, save 15% of pretax income for. For example, if you spend $1, per month, then your emergency fund goal might fall between $3, and $6, Retirement Savings. Investment accounts and. Should you shoot for 20% of your income? There are several different guidelines that you could go by, but there is no one right answer. What's most important. While the size of your emergency fund will vary depending on your lifestyle, monthly costs, income, and dependents, the rule of thumb is to put away at least. At least 20% of your income should go towards savings. Meanwhile, another 50% (maximum) should go toward necessities, while 30% goes toward discretionary items. A savings calculator does the math for you, estimating how much money you'll have in a savings account based on four factors: Initial deposit. This is the. Savings accounts are bank or credit union accounts designed to keep your money safe while paying interest. · Your savings account funds will be easily accessible. The amount you should save every month depends on your financial goals, income, and expenses. Most people start by building an emergency fund of at least three. Many experts agree that most young adults in their 20s should allocate 10% of their income to savings. One of the worst pitfalls for young adults is to push off. Experts typically suggest allocating around 15% of each paycheck to a tax-advantaged retirement account in order to meet your needs. Additionally, it's. In terms of retirement savings, you want to have 1x your salary saved up for retirement by the age of Anything else behind that depends on. Saving Should Be Your Biggest Expense · Needs (like mortgage or rent, utilities, healthcare, food, and childcare expenses) should be paid with 50% of your budget. However, there is no one-size-fits-all approach to savings. How much money you keep in a savings account (or several accounts) depends on your monthly income. So, if you're making $50, per year and have no employer-sponsored retirement plan, you may decide to allocate 10% of your take-home pay to a standard savings. At a bare minimum, aim to keep $1, in a savings account you can use for emergencies. Then, work on building that up to approximately six months of your take-. After all, the typical household has roughly $8, across their bank accounts, per the Federal Reserve. With typical monthly mortgage costs at just under. Our guideline: Aim to save at least 15% of your pre-tax income1 each year, which includes any employer match. That's assuming you save for retirement from age. Maintain a $ minimum daily balance; Have a $1, average monthly collected balance; Hold the account with an individual age 12 and under; Open. The savings calculator can be used to estimate the end balance and interest of savings accounts. It considers many different factors such as tax, inflation, and. An account at an insured bank or credit union is by far the best place to keep your savings. You may opt for a regular savings account, a CD, an IRA, or one of.

Spark Cash Card Review

Spark Cash Plus pay-in-full business credit card from Capital One Assign an account manager to make purchases and payments, review transactions and resolve. The Capital One Spark Cash Plus Credit Card* is a business credit card that earns 2% cash back on all eligible purchases and has no preset spending limit, so it. Easy approval even with low credit score. I was approved for 2k limit with a credit score of The capitalone app is very user friendly as well. The Spark Cash Plus offers excellent rewards for business owners. You'll earn 5% cash back on hotels and rental cars booked through Capital One Travel and. Low-interest card with a competitive cash back offer that applies to all purchases. Rewards have no limits or category restrictions. Pros. A great intro offer. You get great purchase power as the card does not have a preset credit limit. Plus, every year your annual fee of $ will be refunded if you spend $, or. Card was paid off in full every month. Will be moving to a different credit card company, it is impossible to operate reliably with this card. Pros & Cons of Capital One Spark Cash business · Annual fee waived during the first year. · Multiple business credit card perks. · Extended warranty on purchases. With % cash back on all purchases, this card has a simple rewards program that means you don't have to worry about juggling cards to maximize rewards. Spark Cash Plus pay-in-full business credit card from Capital One Assign an account manager to make purchases and payments, review transactions and resolve. The Capital One Spark Cash Plus Credit Card* is a business credit card that earns 2% cash back on all eligible purchases and has no preset spending limit, so it. Easy approval even with low credit score. I was approved for 2k limit with a credit score of The capitalone app is very user friendly as well. The Spark Cash Plus offers excellent rewards for business owners. You'll earn 5% cash back on hotels and rental cars booked through Capital One Travel and. Low-interest card with a competitive cash back offer that applies to all purchases. Rewards have no limits or category restrictions. Pros. A great intro offer. You get great purchase power as the card does not have a preset credit limit. Plus, every year your annual fee of $ will be refunded if you spend $, or. Card was paid off in full every month. Will be moving to a different credit card company, it is impossible to operate reliably with this card. Pros & Cons of Capital One Spark Cash business · Annual fee waived during the first year. · Multiple business credit card perks. · Extended warranty on purchases. With % cash back on all purchases, this card has a simple rewards program that means you don't have to worry about juggling cards to maximize rewards.

The Capital One Spark Cash Plus is a great business charge card for small business owners who spend at least $ per year and want flat-rate cash back. This card is a great all-round business card, offering a decent flat rate for rewards, a sizable sign up bonus and the convenience of no additional fees for. No annual fee. This is a great option for people looking for a low-maintenance cashback card. It gives you cashback on your eligible purchases, but you don't. Business owners can use this card to earn a flat 2% cash back on every purchase with no limits. If you're looking for simple and great cash back, this is. The Capital One Spark Cash Plus (review) is an excellent business card. The card is fantastic whether you're looking to earn cash back or travel rewards. Our rating: More information. Close Our writers, editors and industry experts score credit cards based on a variety of factors including card features. The Capital One Spark Cash Plus is a business card designed for small business owners with excellent credit. It has the highest welcome bonus we've seen on any. Additionally, Capital One has a two-card maximum, regardless of personal or business. It is virtually impossible to hold more than 2 Capital One cards at a time. No Intro APR: While there is cash back opportunity with this card, there is no Intro APR that could be beneficial for big purchases. · Requires good/excellent. Spark Cash Plus pay-in-full business credit card from Capital One Assign an account manager to make purchases and payments, review transactions and resolve. The Capital One Spark Cash Select card is a great choice for business owners looking for simple cash back or flexible financing on their purchases. The Capital One Spark Cash Select for Business card is a cash back rewards business credit card. The card earns % cash back on all purchases. This charge card offers 2% cash back rewards across your business spending, making it a great alternative to a business credit card if you don't plan to. No foreign transaction fees · Free employee cards · Roadside assistance · Capital One Travel deals · Fraud and security alerts · Extended warranty · $0 fraud. Capital One Spark Cash Plus Credit Card · Earn $2, cash back once you spend $30, in the first 3 months. · Get your $ annual fee refunded every year you. The Capital One Spark Cash Plus is a solid cash-back rewards credit card, especially if you use it enough to make the annual fee worth it. Our take: With a $0 annual fee and cash back rewards on every purchase, the Capital One Spark Cash Select for Excellent Credit is a solid business credit card. READ FULL REVIEW > · LEARN MORE · Home · Business Credit Cards; Capital One® Spark® Cash for Business Review. Spark Cash® from Capital One® Credit Card Review. The Capital One Spark Cash Select for Excellent Credit is a cash back card offering % on all purchases and a welcome bonus. This card is ideal for business. The Spark Cash Plus card delivers terrific value despite its annual fee, offering a large sign-up bonus, one of the best flat cash back rates you can find on a.

Best Search Engine For Homes For Sale

If you're looking around for home the best website to use is Zillow. Zillow is a COMPREHENSIVE search engine. It features homes such as FSBO. The 10 biggest Spanish property websites in order. · dariopierro.online Spanish, English and German with 2,, visitors per month, the most visited website for. Search homes for sale, new construction homes, apartments, and houses for rent. See property values. Shop mortgages. Search real estate listings using a map. Search by map to find homes for sale and houses for sale by location. However, in order to get the process moving, you need to start looking at houses. Nestfully offers a great search engine, packed with listings for sale. Find real estate and homes for sale today. Use the most comprehensive source The 10 Markets That Could See the Biggest Home Affordability Gains as Mortgage. The leading real estate marketplace. Search millions of for-sale and rental listings, compare Zestimate® home values and connect with local professionals. The websites mentioned above - Zillow, dariopierro.online, Redfin, Trulia, and dariopierro.online - offer exceptional resources, intuitive interfaces, and comprehensive. 10 Helpful House Hunting Apps for · Zillow. · dariopierro.online Real Estate. · Redfin Real Estate. · Trulia. · dariopierro.online · Movoto. · Rocket Homes. · StreetEasy NYC. If you're looking around for home the best website to use is Zillow. Zillow is a COMPREHENSIVE search engine. It features homes such as FSBO. The 10 biggest Spanish property websites in order. · dariopierro.online Spanish, English and German with 2,, visitors per month, the most visited website for. Search homes for sale, new construction homes, apartments, and houses for rent. See property values. Shop mortgages. Search real estate listings using a map. Search by map to find homes for sale and houses for sale by location. However, in order to get the process moving, you need to start looking at houses. Nestfully offers a great search engine, packed with listings for sale. Find real estate and homes for sale today. Use the most comprehensive source The 10 Markets That Could See the Biggest Home Affordability Gains as Mortgage. The leading real estate marketplace. Search millions of for-sale and rental listings, compare Zestimate® home values and connect with local professionals. The websites mentioned above - Zillow, dariopierro.online, Redfin, Trulia, and dariopierro.online - offer exceptional resources, intuitive interfaces, and comprehensive. 10 Helpful House Hunting Apps for · Zillow. · dariopierro.online Real Estate. · Redfin Real Estate. · Trulia. · dariopierro.online · Movoto. · Rocket Homes. · StreetEasy NYC.

Check this article to learn the best real estate agent websites: 1. Key Home Real Estate 2. Green Ray 3. Tristan Buys Houses + more. This explains why 43% of recent buyers visited search engines to explore new properties for sale. Capitalizing on real estate keywords has become more critical. The app updates every 15 to 30 minutes to keep you on top of the game. You can also draw a box around the area you are searching, and only see homes within that. Welcome to the best home search in the Triangle! With my extensive inventory of listings I'm here to help you find homes and land for sale throughout Raleigh. Search national real estate and rental listings. Find the latest apartments for rent and homes for sale near you. Tour homes and make offers with the help. The dariopierro.online app allows both consumers and HAR members to search for homes for sale or lease across the state of Texas. Key Insights on Top Real Estate Websites in the United States in June As of June , dariopierro.online is the most visited Real Estate website in the United. This article will show the top websites for real estate agents created using Hostinger Website Builder. You'll also find tips and tricks for building your own. Search homes for sale, find home values, get a home loan, and learn more about bank of america home loans. See why dariopierro.online is the #1 fastest growing real estate search site. Use our new neighborhood & school search to find your perfect home. Movoto provides customizable search tools, local market insights, and expert guidance to support you on your path toward homeownership. Realtracs provides the most accurate real estate inventory in Tennessee, Kentucky and Alabama. Confidently find the right home through a collaborative home. As of June , dariopierro.online is the most visited Real Estate website in Canada, attracting M monthly visits. dariopierro.online follows with M visits. Finally, get on Zillow! Sites like Zillow account for 48% of all site traffic for real estate searches, and Zillow itself is probably the most reputable. It's. dariopierro.online is ranked number 1 as the most popular website in the Real Estate category in July The average amount of time that users spend on the website. Effective SEO strategies ensure that real estate websites and listings rank prominently in search engine results. Higher visibility translates to more. At Raleigh Realty, our Realtors will help you find the best Raleigh real estate and homes for sale on the market with our advanced search capabilities. Estately has the most accurate index of homes for sale, straight from the MLS. Estately is an award winning, free real estate resource where you can search. These websites can help people find a real estate agent for selling and buying. Agents can use these platforms to list properties, and buyers can quickly.