dariopierro.online

News

Will Canopy Growth Go Up

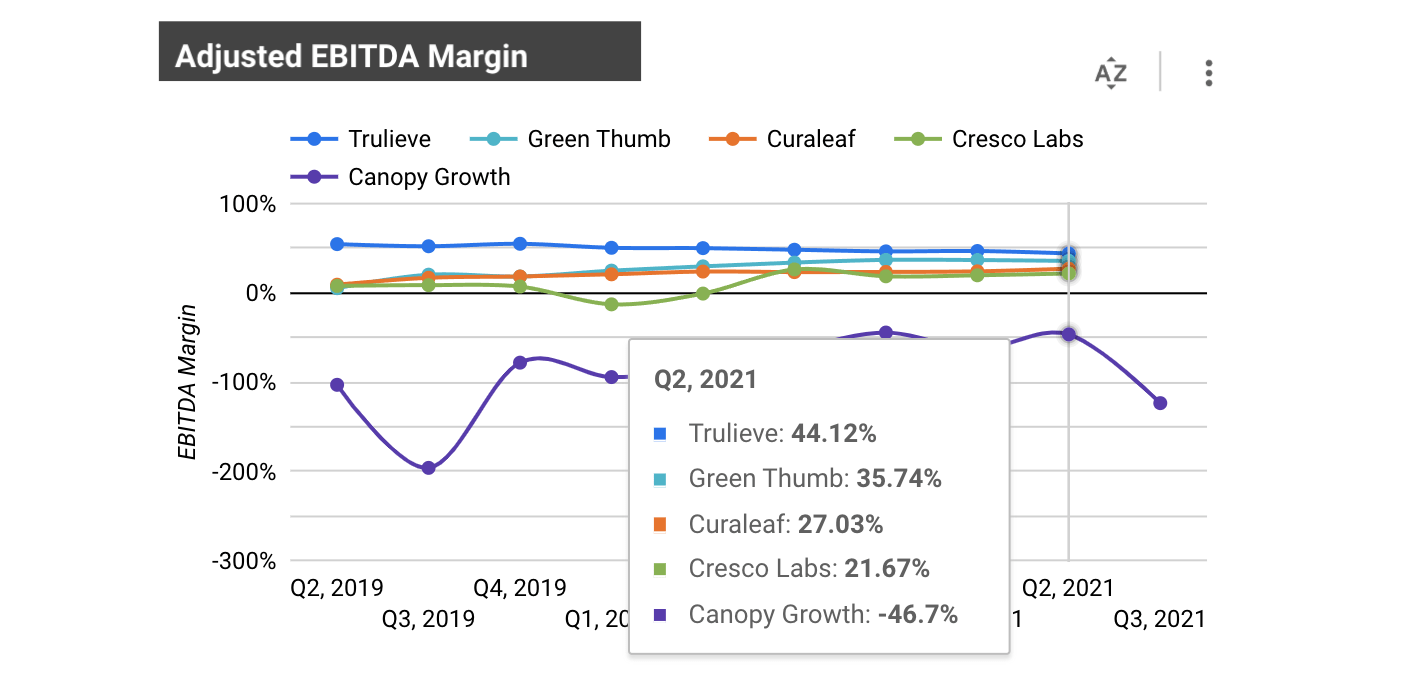

Smiths Falls, ON, July 26, – Canopy Growth Corporation (“Canopy Growth” or the “Company”) (TSX:WEED, NASDAQ:CGC) will release its financial results for. So CANOPY GROWTH CORPORATION technincal analysis shows the sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's. Will Canopy Growth Stock Go Up Next Year? Over the next 52 weeks, Canopy Growth has on average historically risen by 54% based on the past 10 years of stock. Canopy Growth Corporation is a cannabis and consumer packaged goods (CPG) company. The Company delivers innovative products with a focus on premium and. Meaning: The next move is a Wave 3 Impulse, which will catapult Canopy Technical Outlook Canopy Growth Corporation (NASDAQ:CGC) stock is up Canopy Growth, an early mover in the Canadian market, is a multi-faceted cannabis company with a strong investment in brand, market and product differentiation. Canopy Growth to Report First Quarter Fiscal Financial Results on August 9, Canopy Growth Corporation ("Canopy Growth" or the "Company") (TSX: WEED). Canopy Growth's earnings in is -$,,On average, 2 Wall Street analysts forecast CGC's earnings for to be -$,,, with the lowest. Why Canopy Growth Stock Jumped 9% on Monday Chances for near-term marijuana legalization just improved by quite a lot. It Has Been 5 Years Since Canopy Growth. Smiths Falls, ON, July 26, – Canopy Growth Corporation (“Canopy Growth” or the “Company”) (TSX:WEED, NASDAQ:CGC) will release its financial results for. So CANOPY GROWTH CORPORATION technincal analysis shows the sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's. Will Canopy Growth Stock Go Up Next Year? Over the next 52 weeks, Canopy Growth has on average historically risen by 54% based on the past 10 years of stock. Canopy Growth Corporation is a cannabis and consumer packaged goods (CPG) company. The Company delivers innovative products with a focus on premium and. Meaning: The next move is a Wave 3 Impulse, which will catapult Canopy Technical Outlook Canopy Growth Corporation (NASDAQ:CGC) stock is up Canopy Growth, an early mover in the Canadian market, is a multi-faceted cannabis company with a strong investment in brand, market and product differentiation. Canopy Growth to Report First Quarter Fiscal Financial Results on August 9, Canopy Growth Corporation ("Canopy Growth" or the "Company") (TSX: WEED). Canopy Growth's earnings in is -$,,On average, 2 Wall Street analysts forecast CGC's earnings for to be -$,,, with the lowest. Why Canopy Growth Stock Jumped 9% on Monday Chances for near-term marijuana legalization just improved by quite a lot. It Has Been 5 Years Since Canopy Growth.

Based on the reviews from different experts, it is evident that the Canadian cannabis sector, particularly Canopy Growth Corp., is facing high risk and. The question is how much decriminalizing marijuana would increase sales, as it isn't full legalization where it's being sold in stores. Acreage Holdings is excited to announce that we have officially received approval from the state of Pennsylvania to open up to three medical dispensaries in the. Don't forget that globally more countries will legalize and start up their own companies which will chip away market share, CGC will not be. WEED Stock Forecast FAQ Based on analyst ratings, Canopy Growth's month average price target is C$ Currently there's no upside potential for TSE:WEED. The company's CEO Bruce Linton claimed that these funds will aid the company's further international expansion. After the deal with Constellation was officially. Latest On Canopy Growth Corp There is no recent news for this security. Content From Our Affiliates. Cannabis Stocks Are Lighting Up Investors' Portfolios. ETF MSOS is seen as an opportunity to get exposure to stocks that are not yet U.S. listed. Earnings Revisions · FY1 Up Revisions ; Valuation · P/E Non-GAAP (FWD). NM. P/E GAAP (TTM). NM. Price/Book (TTM). EV/Sales (TTM) ; Growth · Revenue (YoY). -. Canopy Growth stock can go back up after lowering its debt burden and growing gross margins by 34% year-over-year. The debt and. Canopy Growth Corp. engages in the production, distribution, and sale of cannabis and cannabinoid-based products for both adult-use and medical purposes. Canopy Growth Stock: Can It Sustain Recent Gains? Canopy Growth is improving its margins and inching closer to profitability. However, proposed changes to the. The downward trend observed during this period was punctuated by brief periods of growth, such as the $ million increase recorded from September 30, Will Canopy Growth Corp stock go up? Based on targets from 8 analysts, the average taret price for WEED:CA is projected at CAD over the next 12 months. Based on the Rule 16, the options market is currently suggesting that Canopy Growth Corp will have an average daily up or down price movement of about % per. On corrections up, there will be some resistance from the lines at $ and $ A break-up above any of these levels will issue buy signals. A sell. The writing could be on the wall for psychedelics namely mushrooms to go the medical and rec route of Cannabis and negotiating this kind of merge is right up. This is an increase of 10% compared to the previous 30 days. Previous Next. Company Ownership. Canopy Growth Corporation (NASDAQ:CGC) shares are trading higher Tuesday after cannabis-peer Tilray Brands, Inc. (NASDAQ:TLRY) reported better-than-expected.

Mortgage Companies That Help With Low Credit Scores

What mortgage lenders are available if I have a low credit score? · 1. Pepper Money · 2. Bluestone Mortgages · 3. Vida Homeloans · 4. Kensington Mortgages · 5. MBS. loans or financial assistance without improving your score. With bad credit, you need financial help to get you out of your situation. While poor credit history. How to buy a house with bad credit: 5 loan options · FHA loans · VA loans · USDA loans · Fannie Mae HomeReady® loans · Freddie Mac Home Possible® loans. Riverbank mortgage professionals can help with Michigan bad credit mortgage loans score each time and several credit inquiries look bad to banks and lenders. We can often accept a minimum credit score as low as when you want to tap into your home's equity with a VA loan. At Freedom Mortgage, we can also help you. If you're looking to buy a home but have poor credit, Blue Water Mortgage has access to a variety of home loan options for people with bad credit. Have or below credit? Looking for a home loan? No problem. Mortgage Investors Group is passionate about affordable housing in the Southeast. While most banks stop considering loan approvals at a below credit score, at Cornerstone First, we have the ability to go to on both VA and FHA Loans. Prosperity Home Mortgage is our choice as the best overall lender for borrowers with poor or fair credit because of its range of mortgage products and. What mortgage lenders are available if I have a low credit score? · 1. Pepper Money · 2. Bluestone Mortgages · 3. Vida Homeloans · 4. Kensington Mortgages · 5. MBS. loans or financial assistance without improving your score. With bad credit, you need financial help to get you out of your situation. While poor credit history. How to buy a house with bad credit: 5 loan options · FHA loans · VA loans · USDA loans · Fannie Mae HomeReady® loans · Freddie Mac Home Possible® loans. Riverbank mortgage professionals can help with Michigan bad credit mortgage loans score each time and several credit inquiries look bad to banks and lenders. We can often accept a minimum credit score as low as when you want to tap into your home's equity with a VA loan. At Freedom Mortgage, we can also help you. If you're looking to buy a home but have poor credit, Blue Water Mortgage has access to a variety of home loan options for people with bad credit. Have or below credit? Looking for a home loan? No problem. Mortgage Investors Group is passionate about affordable housing in the Southeast. While most banks stop considering loan approvals at a below credit score, at Cornerstone First, we have the ability to go to on both VA and FHA Loans. Prosperity Home Mortgage is our choice as the best overall lender for borrowers with poor or fair credit because of its range of mortgage products and.

Artisan Mortgage offers Bad Credit Home Mortgage Loans in New York & Pennsylvania and subprime mortgages to people with low + FICO scores in Long Island. If the answer to these questions is yes, Clear Lending, one of the best mortgage lenders for low credit scores, offers Home Loans for Bad Credit in Houston at. Most lenders use FICO® scores from all three credit bureaus when evaluating your loan application. Your score will likely be different for each credit bureau. At Cornerstone First, our low credit score + mortgage loan programs enable us to close loans that other institutions cannot. Mortgage options for low. Mortgage lenders typically consider any credit score under as bad credit when evaluating loan applications. This range can vary slightly among lenders, but. With a or lower credit score, you'll have to go through manual underwriting so that mortgage lenders can get into the details of your financial. What mortgage lenders work with a low credit score? This Lender Search List from the U.S. Department of Housing and Urban Development can help you find. Before talking yourself out of applying, talk to a mortgage lender at First Ohio Home Finance to see what possible options are. We're here to help you find. Best Mortgage Lenders for High Credit Scores ; loanDepot. ; Veterans United. ; PennyMac. ; Rocket Mortgage. Because of this insurance, mortgage lenders are more likely to approve loans for borrowers with low credit scores and low incomes. The FHA minimum credit score. USDA Mortgage Lenders · Flagstar Bank – this lender has cheaper than industry-average mortgage rates, but you might want to consider improving your credit or. Bad Credit FHA Mortgage Loans Bad Credit FHA Mortgage Loans are mortgage options that allow you to buy a home or refinance your current mortgage with less. For over 30 years Churchill Mortgage has been on a mission to lead our clients to the ultimate American dream — debt-free homeownership. We believe debt-free. We have access to low FICO lenders who are willing to work with New York homebuyers with low credit scores. As a result, we can offer a variety of bad credit. While most banks stop considering loan approvals at a below credit score, at Cornerstone First, we have the ability to go to on both VA and FHA Loans. The reason why a cosigner could help is the lender could collect from your cosigner if you default on your mortgage. As a result, having a cosigner with. In my experience Vantage scores are higher than FICO, and lenders are also using FICO scores. Edit: if you want, you can pay through FICO. What Do Mortgage Lenders Consider A Bad Credit Score? · – Poor · – Fair · – Good · – Very Good · – Exceptional. Many companies will not lend to borrowers with scores below a or a Though, low scores alone shouldn't disqualify you from a home loan. It may simply. That is why we offer poor credit loans, also known as “hard money loans” or “subprime mortgages.” Low FICO Score? We Can Help. If other lenders have turned you.

How To Add Business To Google Search Engine

How to Add Social Media Links to Your Google Business Profiles. May 17, Ready to Transform Your Local Search Strategy? First Name. Last Name. How to claim your Google Business Profile · Postcard Verification Make sure your business address is correct, add a contact name (optional) and have Google. This guide explains how to improve your business listing to enhance your details on Google Search results, the Google knowledge panel, and Google Maps. How to claim your Google Business Profile · Postcard Verification Make sure your business address is correct, add a contact name (optional) and have Google. If you already have an account, visit Google's business page, click the 'Manage now' button, and complete the steps to create your local profile. You'll have to. There are no secrets here that'll automatically rank your site first in Google (sorry!). In fact some of the suggestions might not even apply to your business. Go to Google Business Profile in your site's dashboard. · Click Start Now. · Select Create New Profile. · Enter the name of your business in the search bar. How to Add Social Media Links to Your Google Business Profiles. May 17, Ready to Transform Your Local Search Strategy? First Name. Last Name. Get your business hours, phone number and directions on Google Search and Maps with a Google Business Profile. How to Add Social Media Links to Your Google Business Profiles. May 17, Ready to Transform Your Local Search Strategy? First Name. Last Name. How to claim your Google Business Profile · Postcard Verification Make sure your business address is correct, add a contact name (optional) and have Google. This guide explains how to improve your business listing to enhance your details on Google Search results, the Google knowledge panel, and Google Maps. How to claim your Google Business Profile · Postcard Verification Make sure your business address is correct, add a contact name (optional) and have Google. If you already have an account, visit Google's business page, click the 'Manage now' button, and complete the steps to create your local profile. You'll have to. There are no secrets here that'll automatically rank your site first in Google (sorry!). In fact some of the suggestions might not even apply to your business. Go to Google Business Profile in your site's dashboard. · Click Start Now. · Select Create New Profile. · Enter the name of your business in the search bar. How to Add Social Media Links to Your Google Business Profiles. May 17, Ready to Transform Your Local Search Strategy? First Name. Last Name. Get your business hours, phone number and directions on Google Search and Maps with a Google Business Profile.

Google My Business (GMB) is a service that Google provides to business owners, so they can manage what appears in SERPs when users search for their business. What is Google Business Profile? Many businesses create a Google business listing, aka their Business Profile, to increase visibility on the commonly-used. Google My Business is an all-in-one free (that's right) tool that allows you to manage and control your digital presence in local Google search engines and. When it comes to local search engine optimization (SEO), making sure you have a verified, optimized Google Business Profile is crucial to your online success. How do I get my business on Google search? · 1. Optimize for organic SEO · 2. Set up Google Business Profile · 3. Launch a paid advertising campaign. Google Business Profile news, analysis, trends, tactics, and how-to guides from Search Engine Land, the publication SEO & PPC pros rely on. Submit your website sitemap to Google Search Console. Add local business schema to your website. Do proper keyword research and identify your. Make it yours · Choose sites to include · Decide if you want users to search only your website, or include other sites on the web. · Match the design to your site. To qualify for a Google Business Profile, you need to be either a bricks-and-mortar company (like a venue or a gallery), or a service company operating in a. When you search, you've probably seen something like the image below. That's a free Business Profile on Google. You can add photos, update hours and more to. Yes, it's free to create your Business Profile on Google. Create your profile at no cost, and you can manage your business from Google Search and Maps to start. Once you verify your business, it will show up on Google Maps when people search for it. If you add more information and make sure everything is correct, your. Appearing on search engines' results pages is key to driving organic traffic and customers to your business. If you have a local business with a physical. Sign in to your Google Account. If you don't have one, sign up for free. · Go to create a profile. · Enter your business name, service area address, phone number. Adding a description and selecting a category for your official URL will also help to boost the SEO, or the search engine optimization of your website. Location. SEO stands for search engine optimization. This boils down to the way your business ranks in organic searches on search engines like Google. Put more simply. Google Business Profile news, analysis, trends, tactics, and how-to guides from Search Engine Land, the publication SEO & PPC pros rely on. One essential requirement is to have a Google account. You can create and manage your business listing from your Google account. If you don't have one, creating. Step 1 – Head to Google's business page. First, go to dariopierro.online and click on the “Manage now” button located at the top right-hand corner of the.

How Much Does 401k Cost Per Month

$5, to $10, a year; Initial start-up fee $ - $3,; Quarterly per participant charges $15 - $40; Administrative fees - $ - $1, a year. Small. Plans start as low as $ per month + $6 per participant per month. In general, "qualified startup costs" are ordinary and necessary expenses of an. You will pay a 25% surrender charge for any amount you withdraw before annuity payments begin. If your income payments are less than $50 per month, the. (k) Early Withdrawal Costs Calculator ; Early withdrawal amount ; Federal income tax rate ; State income tax rate ; Local/city income tax rate ; Are you employed? Monthly fees start at $ per month, plus an annual % of assets and "How Much Does Offering a (k) Cost an Employer?" Take the Next Step to. Must participate in the plan within two months of being hired; Should be eligible for matching or nonelective employer contributions as if they were employed. But where healthcare costs can run between $6, (for single coverage) to $18, (for family coverage) per employee per year, 1 a (k) plan cost is only a. Plans as low as $19 / mo. Transparent and affordable (k) pricing with a range of plans to fit your retirement needs. cost to the employer (e.g. $3/month per participant). That can add up and How does your (k) provider keep costs in check? We automatically lower. $5, to $10, a year; Initial start-up fee $ - $3,; Quarterly per participant charges $15 - $40; Administrative fees - $ - $1, a year. Small. Plans start as low as $ per month + $6 per participant per month. In general, "qualified startup costs" are ordinary and necessary expenses of an. You will pay a 25% surrender charge for any amount you withdraw before annuity payments begin. If your income payments are less than $50 per month, the. (k) Early Withdrawal Costs Calculator ; Early withdrawal amount ; Federal income tax rate ; State income tax rate ; Local/city income tax rate ; Are you employed? Monthly fees start at $ per month, plus an annual % of assets and "How Much Does Offering a (k) Cost an Employer?" Take the Next Step to. Must participate in the plan within two months of being hired; Should be eligible for matching or nonelective employer contributions as if they were employed. But where healthcare costs can run between $6, (for single coverage) to $18, (for family coverage) per employee per year, 1 a (k) plan cost is only a. Plans as low as $19 / mo. Transparent and affordable (k) pricing with a range of plans to fit your retirement needs. cost to the employer (e.g. $3/month per participant). That can add up and How does your (k) provider keep costs in check? We automatically lower.

Administrative fees often run about $ to $ per participant per year. These fees may or may not be disclosed. Employers sometimes pay these fees, said. They are often the largest component of retirement plan costs and are paid by all shareholders of the investment option. Typically, asset-based fees are. If we break it down, that means you'd need to contribute about $1, per month, or $ per paycheck (without your employer match). And if we were to look at. Where do you live? Your location is used to determine taxes in retirement. Do this later. Dismiss. Next. (k) fees can range between % and 2% or even higher, based on the size of an employer's (k) plan, how many people are participating in the plan, and. It may surprise you how significant your retirement accumulation may become simply by saving a small percentage of your salary each month in your (k) plan. The average age to retire is 65 for men and 63 for women, so it's not surprising to see the average and median (k) balance figures start to decline in. This covers the cost of holding the assets, and it's about $ per month for every $10, saved. Fund fees as low as %. Averaging at about %. With Fidelity, you have no account fees and no minimums to open an account.1 You'll get exceptional service as well as guidance from our team. Open a self-. Let's say you work 23 years and the average of your highest 60 months of income (AFC) is $5, per month. 2% x 23 years x $5, = $2, When you retire, you. We set this pricing structure to keep it simple and the funds in the lineup do not charge management fees or, with limited exceptions, fund expenses. Employees. I own a small business and our retirement options are very limited and come with a $ per person management fee. There are very few options out there. My non-profit employer has a k that charges my account $/quarter. If I take an average, it's costing me (this cannot be changed as that's the cost to. Investment management fees These fees make up a piece of an investment's expense ratio, which is the percentage fee charged within the mutual funds you've. $ monthly base fee, billed each calendar year annually ($1,) · +$5. monthly record-keeping fee per participant · +%. annual advisory fee. Pricing for individuals with a balanceFootnote 7. Monthly recordkeeping fees: $ Annual asset based costsFootnote †. Recordkeeping fee will be billed to business owners quarterly ($ plus per-participant fees). Pricing shown applies when working with a third party. SIMPLE IRAs · $25 for each Vanguard mutual fund in each account. ; (b) plans · $5 per month per Participant ($60 per year). ; Individual (k) & Individual Roth. With a 50% match, your employer will add another $ to your (k) account. If you increase your contribution to 10%, your annual contribution is $2, per. The plan may state this promised benefit as an exact dollar amount, such as $ per month at retirement. an easy, low-cost retirement plan option for.

Crypto Currency Capital Gains Tax

After calculating all of your capital gains or losses on Schedule D, you need to report any cryptocurrency income from non-trade or exchange related activities. Crypto is not considered to be a currency by the IRS but is considered property. As property can have capital gains and losses, crypto can, too. The capital. Meanwhile, long-term Capital Gains Tax for crypto is lower for most taxpayers. You'll pay a 0%, 15%, or 20% tax rate depending on your taxable income. If you. HMRC do not consider cryptoassets to be currency or money, or that buying or selling cryptoassets is gambling. This means that, in HMRC's view, profits or gains. Only when they are sold for GBP should there be a taxable event. Property, Gold, Stocks, Shares, they are all subject to tax when selling to currency (legal. Capital Gains Taxes and Cryptocurrency Cryptocurrency is generally treated like a commodity for income tax purposes. This means that profits realized by. The federal capital gains tax — a tax on profits you make from selling certain types of assets — also applies to your crypto transactions. Rates range from 0%. If you use virtual currency but do not operate a business, we consider that your transactions give rise to a capital gain or loss. Generally speaking, you. The federal capital gains tax — a tax on profits you make from selling certain types of assets — also applies to your crypto transactions. Rates range from 0%. After calculating all of your capital gains or losses on Schedule D, you need to report any cryptocurrency income from non-trade or exchange related activities. Crypto is not considered to be a currency by the IRS but is considered property. As property can have capital gains and losses, crypto can, too. The capital. Meanwhile, long-term Capital Gains Tax for crypto is lower for most taxpayers. You'll pay a 0%, 15%, or 20% tax rate depending on your taxable income. If you. HMRC do not consider cryptoassets to be currency or money, or that buying or selling cryptoassets is gambling. This means that, in HMRC's view, profits or gains. Only when they are sold for GBP should there be a taxable event. Property, Gold, Stocks, Shares, they are all subject to tax when selling to currency (legal. Capital Gains Taxes and Cryptocurrency Cryptocurrency is generally treated like a commodity for income tax purposes. This means that profits realized by. The federal capital gains tax — a tax on profits you make from selling certain types of assets — also applies to your crypto transactions. Rates range from 0%. If you use virtual currency but do not operate a business, we consider that your transactions give rise to a capital gain or loss. Generally speaking, you. The federal capital gains tax — a tax on profits you make from selling certain types of assets — also applies to your crypto transactions. Rates range from 0%.

Digital currencies, including cryptocurrencies, are subject to taxation under ordinary income tax rules. Gains and losses from buying and selling. Cryptocurrency should be reported when you go through taxable events, which includes realizing or generating income. If you owe capital gains tax on your. What is the tax rate on cryptocurrency? · Ordinary income rates are between 10% and 37% depending on your income tax bracket. · Short-term capital gain rates are. Since Notice provides that gain or loss on cryptocurrency transactions can be capital, it appears that hedges entered into with respect to digital. Crypto taxes work similarly to taxes on other assets or property. They create taxable events for the owners when they are used and gains are realized. A major challenge for investors in cryptocurrency is being able to track their capital gains and losses. It is common to transact with cryptocurrencies in. As such, virtual currency received as payment by an individual or business must be included as miscellaneous income as an exchange of property or service. The. A major consideration from a state tax perspective is whether or not the purchase of virtual currency or cryptocurrency is a taxable sale for sales and use tax. If you sold a previously purchased NFT, it's considered capital gains, and only 50% of your earnings get taxed. What happens if you don't report your crypto. Do I owe capital gains tax on a sale of cryptocurrency? You will generally owe Washington's capital gains tax on a sale of cryptocurrency if you hold it for. How to report cryptocurrency on your taxes · Capital gains are reported on Schedule D (Form ). · Gains classified as income are reported on Schedules C and SE. Capital gains taxes apply to cryptocurrency sales. Cryptocurrency income is taxed based on its fair market value on the date you receive it. The Income Tax Act makes it clear there is a taxable event whenever you dispose of property (which is what you do when you trade one cryptocurrency for another). How much you get taxed will largely depend on if the CRA views your crypto transactions as capital gains or business income. If it's the former, you'll have to. The direct taxes are Corporation Tax ('CT'), Income Tax ('IT') and Capital Gains Tax ('CGT'). As with any other activity, the treatment of income received from. Back in , the IRS issued a statement that virtual currency is treated as property for federal income tax purposes and the capital gains taxation rules apply. The direct taxes are Corporation Tax ('CT'), Income Tax ('IT') and Capital Gains Tax ('CGT'). As with any other activity, the treatment of income received from. If you earn money from exchanging (trading or selling) coins and tokens, you might owe Capital Gains Tax. If you earn money from staking or mining crypto, you'. The federal capital gains tax — a tax on profits you make from selling certain types of assets — also applies to your crypto transactions. That means they're treated a lot like traditional investments, such as stocks, and can be taxed as either capital gains or as income. Bookmark our full crypto.

Iphone Se Evolution

As we embark on this journey through the iPhone's evolution, we're The iPhone SE combined the design of the iPhone 5s with the internals of the. Description. This case provides a protective yet stylish shield to your iPhone SE 3rd Gen from accidental drops and scratches. Available in Rubber case . The first iPhone SE model was launched in It offered most features of the more expensive iPhone 6s models, barring 3D Touch. Housed in the body of an. War of Evolution lets you control the development of a species from the iPhone SE · Compare iPhone · Switch from Android. Shop iPhone. Shop iPhone · iPhone. iPhone SE (). The iPhone SE was a nod to those who preferred the smaller form factor of earlier iPhones but desired the performance and. Discover many more exciting features by downloading the iOS 17 update, available on all iPhones from the iPhone SE upwards. With this update, your iPhone is. iPhone 5S & 5C: September 20, · iPhone 6 & 6 Plus: September 19, · iPhone 6S & 6S Plus: September 19, · iPhone SE: March 31, iPhone 5S () 9. iPhone 6 () iPhone 6 Plus () iPhone 6S () iPhone 6S Plus () iPhone SE () iPhone. Product information ; Heavy duty protection · Wireless · December 5, · Heavy duty protection · iPhone SE () / 7 / 8. As we embark on this journey through the iPhone's evolution, we're The iPhone SE combined the design of the iPhone 5s with the internals of the. Description. This case provides a protective yet stylish shield to your iPhone SE 3rd Gen from accidental drops and scratches. Available in Rubber case . The first iPhone SE model was launched in It offered most features of the more expensive iPhone 6s models, barring 3D Touch. Housed in the body of an. War of Evolution lets you control the development of a species from the iPhone SE · Compare iPhone · Switch from Android. Shop iPhone. Shop iPhone · iPhone. iPhone SE (). The iPhone SE was a nod to those who preferred the smaller form factor of earlier iPhones but desired the performance and. Discover many more exciting features by downloading the iOS 17 update, available on all iPhones from the iPhone SE upwards. With this update, your iPhone is. iPhone 5S & 5C: September 20, · iPhone 6 & 6 Plus: September 19, · iPhone 6S & 6S Plus: September 19, · iPhone SE: March 31, iPhone 5S () 9. iPhone 6 () iPhone 6 Plus () iPhone 6S () iPhone 6S Plus () iPhone SE () iPhone. Product information ; Heavy duty protection · Wireless · December 5, · Heavy duty protection · iPhone SE () / 7 / 8.

Evolution of iPhone models from the original iPhone to the iPhone 15 series. iPhone SE (1st gen), 4", , , 16, iPhone SE, Compact Powerhouse. As iPhones grew larger and more expensive, not everyone was keen on the trend. Fortunately, Apple launched the iPhone SE. iPhone SE Skin · iPhone XR Skin · MacBook Pro 16″ Skin · Custom Size Laptop Evolution of the iPhone: Size matters. From the camera quality to. Camera: Apple iPhone SE. Explore more photos uploaded by the camera Apple A fan made site for Evolve Owners & Electric Skateboarders. Forum software. Release dates ; 9 · iPhone SE (1st generation), Mar 21, , March 31, ; 8 years ago (), September 12, ; 5 years ago (). I-Phone SE This one was a bit of a surprise. We'd expected a smaller iPhone with a lower price tag, but we didn't expect it to look like the iPhone 5 but with. iPhone Comparison Chart · iPhone 16 Series · iPhone 16 Pro Series · iPhone 15 Series · iPhone 15 Pro Series · iPhone 14 Series · iPhone 14 Pro Series · iPhone SE 3. The original iPhone · The iPhone 3G and 3GS · The iPhone 4 and 4S · The iPhone 5, 5C and 5S · iPhone 6 and iPhone 6 Plus () · iPhone 6s and. Battery (Extended Capacity with TI Board) for Apple iPhone SE () (Evolve) | Wholesale Gadget Parts. Evolution of Money iPhone Case is a high-quality product that matches your love for the web3, Made in India, of course. dariopierro.online is an Indian security. | 14th Generation (iPhone SE 2nd Gen and iPhone 12 Series). iPhone SE 2nd Gen: Compact and affordable option. iPhone 12 Series: 5G connectivity. MagSafe. iPhone SE (): Combining the power of the 6S with a compact design, the SE targeted users who preferred a smaller phone. iPhone 7 and 7. Apple may be developing an updated version of the low-cost iPhone SE, with the device slated to include some major changes to bring it in line with the. iPhone 5/5S/SE rear side). In fact, I'd even say the durability of modern iPhones reverted back to the 4S era with glass backs. You might be. For my first stem post I'm going to go into technology, I am going to be talking about the evolution of the popular Apple's iPhone series. iPhone SE was. March brought Apple fans a nice surprise with the launch of a pocket-sized powerhouse: the iPhone SE. But how does this throwback phone shape up to its. PERFORMANCE: Overall the Apple iPhone SE did well but was not among our top scorers. Many users will be satisfied with its performance especially if. Apple's iPhone 7 and 7 Plus are now available online and in Apple stores. · Evolution of Apple's iconic iPhone: to · Apple iPhone 5 — The first 'Retina'. What are the Last Three Series? · iPhone 13 - Release Date: September 24, · iPhone SE 3 - Release Date: March 18, · iPhone 14 - Release Date: September. Apple may be developing an updated version of the low-cost iPhone SE, with the device slated to include some major changes to bring it in line with the.

What Is Virginia Taxable Income

What are Virginia's Filing Requirements? · Single - $11, · Married Filing Jointly - $23, · Married Filing Separately - $11, The due dates for Virginia Estimated tax payments are May 1st, June 15th, September 15th, and January 15th of the following tax year. What tax breaks are. Use this calculator to compute your Virginia tax amount based on your taxable income. To calculate your Virginia tax amount, enter your Virginia taxable income. Filing requirements are based on residency, status, and income amounts. Students and dependents follow the same guidelines. Income or gain from US stocks, bonds, treasury bills, and treasury notes may be subtracted from federal taxable income, but interest on refunds of federal. Interest on obligations of any state other than Virginia or on the obligations of a political subdivision of such other state or interest or dividends on. Virginia has a graduated state individual income tax, with rates ranging from percent to percent. Virginia has a percent corporate income tax rate. Virginia allows a Non-Refundable Earned Income Tax Credit, equal to 20% of the Federal Credit, on the state return. In Virginia, taxpayers. The law requires that all employers withhold tax from the income of nonresident employees, if federal law requires the withholding. Any compensation received. What are Virginia's Filing Requirements? · Single - $11, · Married Filing Jointly - $23, · Married Filing Separately - $11, The due dates for Virginia Estimated tax payments are May 1st, June 15th, September 15th, and January 15th of the following tax year. What tax breaks are. Use this calculator to compute your Virginia tax amount based on your taxable income. To calculate your Virginia tax amount, enter your Virginia taxable income. Filing requirements are based on residency, status, and income amounts. Students and dependents follow the same guidelines. Income or gain from US stocks, bonds, treasury bills, and treasury notes may be subtracted from federal taxable income, but interest on refunds of federal. Interest on obligations of any state other than Virginia or on the obligations of a political subdivision of such other state or interest or dividends on. Virginia has a graduated state individual income tax, with rates ranging from percent to percent. Virginia has a percent corporate income tax rate. Virginia allows a Non-Refundable Earned Income Tax Credit, equal to 20% of the Federal Credit, on the state return. In Virginia, taxpayers. The law requires that all employers withhold tax from the income of nonresident employees, if federal law requires the withholding. Any compensation received.

The Commissioner of the Revenue is responsible for receiving and processing all Virginia state income tax returns and initial estimated tax payments for City. The due dates for Virginia Estimated tax payments are May 1, June 15, September 15, and January 15 of the following tax year. What tax breaks are available. You should request a refund by filing a properly completed return for the tax year in question and providing all the necessary documentation/schedules. The Commissioner of Revenue's office provides assistance in preparing and filing Virginia Individual Income Tax Returns. Who Must File VA State Income Tax · Single and your VAGI is $11, or more · Married filing jointly and your combined VAGI is $23, or more · Married filing. The Commissioner's Office prepares and electronically files state tax returns. Virginia has a graduated income tax, with rates ranging from 2 percent to percent. Virginia has a percent sales tax. See Virginia tax rates. Virginia's average combined state and local sales tax rate is %. The statewide median property tax rate is generally below average, too. View the current income tax rates for individuals. The starting point for determining West Virginia personal income tax liability of individuals, and married persons filing a joint return, is the taxpayer's. A Virginia income tax is imposed on all income from Virginia sources which is defined as federal taxable income with certain specified additions, subtractions. Virginia has a progressive income tax, with a 2 percent tax rate on the first $3, of income, all the way up to percent for taxable income over $17, If you're retired and don't have Virginia withholdings taken out of your retirement income and want the income covered for Virginia taxes, file Virginia Form. You may electronically file or use paper forms to file your State Income Tax Return. There are three e-File options to choose from - Virginia Free File, Paid e-. When taxable income is commingled with exempt income all income is presumed taxable unless the portion of income which is exempt from Virginia income tax can be. What is the rate for Virginia individual income taxes? Attachment for TAXES , Virginia State Income Tax Withholding. Beginning with wages paid for Pay Period 4, the National Finance Center (NFC) will make. Virginia taxable income for a taxable year means the federal taxable income and any other income taxable to the corporation under federal law. Social Security retirement benefits are not taxed in Virginia. Other types of retirement income, such as pension income and retirement account withdrawals, are. The Commissioner of the Revenue is responsible for receiving and processing all Virginia state income tax returns and initial estimated tax payments for.

Grimes Auction

NOW OPEN! Grimes Finds Weekly Key Comic Book Online Auction! *+ Items Available * $1 Starting Bids / No Reserves * Worldwide Shipping * Easy Free bidding. View photos and descriptions of 3 estate sales & auctions happening this week near Grimes, Iowa New estate sales every week. Browse upcoming auctions from Grimes Auction Service in Lacon,IL on AuctionZip today. View full listings, live and online auctions, photos, and more. Reg. #: +*, DOB: 9/10/, Consignor: David Grimes. Grimes Machinery Auction · ask the auctioneer · Auction Info · Thanks for visiting! Stay connected with Aumann Auctions and get updates on new auctions, last. Auction Archived post. New comments cannot be posted and votes cannot be cast. A few things were sold for like 50 bucks! Not bad! thank. See All Farm Equipment Online Auctions near you By Grimes Auction Service N High St, Lacon, Illinois +1 Contact Us AUCTIONEERS' NOTE: Mary M. Grimes was a long-time well-known Longaberger Dealer, she amassed a massive collection throughout the years! An. GRIMES AUCTION, LLC · HOME · RUN LIST / INVENTORY · CONTACT. HIGHWAY 49 NORTH PARAGOULD, AR. NEXT AUCTION: FRIDAY AUGUST 4, AT 9 AM. NOW OPEN! Grimes Finds Weekly Key Comic Book Online Auction! *+ Items Available * $1 Starting Bids / No Reserves * Worldwide Shipping * Easy Free bidding. View photos and descriptions of 3 estate sales & auctions happening this week near Grimes, Iowa New estate sales every week. Browse upcoming auctions from Grimes Auction Service in Lacon,IL on AuctionZip today. View full listings, live and online auctions, photos, and more. Reg. #: +*, DOB: 9/10/, Consignor: David Grimes. Grimes Machinery Auction · ask the auctioneer · Auction Info · Thanks for visiting! Stay connected with Aumann Auctions and get updates on new auctions, last. Auction Archived post. New comments cannot be posted and votes cannot be cast. A few things were sold for like 50 bucks! Not bad! thank. See All Farm Equipment Online Auctions near you By Grimes Auction Service N High St, Lacon, Illinois +1 Contact Us AUCTIONEERS' NOTE: Mary M. Grimes was a long-time well-known Longaberger Dealer, she amassed a massive collection throughout the years! An. GRIMES AUCTION, LLC · HOME · RUN LIST / INVENTORY · CONTACT. HIGHWAY 49 NORTH PARAGOULD, AR. NEXT AUCTION: FRIDAY AUGUST 4, AT 9 AM.

Grimes has put to auction her personal clothes & items in partnership with Austin Habitat to help reduce housing costs in Texas Archived post. AUCTION For MAUI: Steve Grimes Custom (Mastergrade Koa Tenor #) Mahalo to Steve Grimes for the amazing instrument and donation to help his neighbors on. Best Auction Houses in Grimes, IA - Auction Outlet of Iowa, Caring Transitions of Central IA, Putney Auction Service, Daugherty Auction & Real Estate. Auction & Buyer Info. Auction Sheets. Premium Sale Sheet · Freezer Sale Sheet · Add-On Form (ALL Add-On's MUST be completed on sale night or emailed by. Grimes Auction Service. likes · 10 talking about this. Auction Time authorized representative. Farm and small estate sales. Auction Description. Misc Boxes, Luggage, totes, plastic storage drum, digital mixer, Dewalt radio. Auction held by LockBox Storage Grimes. Notice: The laws. Find Farm Machinery for sale from Grimes Auction Service - Lacon, Illinois. Go to Farm And Plant Ireland, your trusted site to buy & sell. SE Capitol Circle, Grimes, IA - Ricks Towing & Transport - FREE estimates. Abandoned vehicle auction. Public auction. This is a continuation of the auction we did for Joe Grimes and his late wife Jody Grimes in March of this year. It's a rather small but quality auction. WELCOME TO GRIMES EQUIPMENT SALES We are located just off highway 49 on the North side of Paragould, Arkansas. We try to stock a large variety of quality. Find Farm Equipment for sale from Grimes Auction Service. Go to dariopierro.online, your trusted site to buy & sell Farm Equipment. Browse upcoming auctions from Grimes auction service in Roseboro,NC on AuctionZip today. View full listings, live and online auctions, photos, and more. Auction Locations. Alabama. ADESA Birmingham. Arizona. ADESA Phoenix Address. SE Gateway Dr, Grimes, IA View on Map. Contact Information. Grimes Finds Amazing April Collectibles Sale! is on dariopierro.online, the leading live and online auction platform. View details & auction catalog and start bidding. Grimes Auction Service. Home Notify Me! ™ Announcements Email. Search: Search Within Results: No Records Found. Search. © TopAuctionscom. Open and Consignment Auction: Tractors, Farm Equipment, Construction Equipment, Mowers, Automobiles, Motorcycles, Cattle Feeders, Round Bale Hay Rings. GRIMES AUCTION, LLC · HOME · RUN LIST / INVENTORY · CONTACT. HIGHWAY 49 NORTH PARAGOULD, AR. INVENTORY UPDATED DAILY CHECK BACK FOR UPDATES. CLICK. Get more information for Grimes Auction Service in Roseboro, NC. See reviews, map, get the address, and find directions. Find Farm Equipment for sale from Grimes Auction Service - Lacon, Illinois. Go to dariopierro.online, your trusted site to buy & sell Farm Equipment. Follow long with Justin and Jeana Grimes owner of Dallas Online Auction Block in Dallas, Tx on his weekly adventures to pay for his storage auction.